Have you ever thought of what will happen to your wealth and assets or in layman’s terms of money if you died without a will in Malaysia?

Ever thought of seeking for a law firm in Malaysia such as Sim & Rahman for a solicitor’s advice or solution from a verified law firm in Malaysia even though you don’t have loads of money in your bank or investment accounts?

Now, here’s why you should not skim through this important article that could change the lives of your loved ones!

Table of Contents

Yes, it’s that boring topic about seeking for a solicitor’s advice or law firm in Malaysia to properly distribute our wealth to the ones who we love and trust the most.

All this has to be done in advanced to avoid unforeseen circumstances when some unexpected life event strikes us.

Nobody knows what will happen to our lives even though we’re a truly positive person and always hope for the best in our lives.

Seeking for a solicitor’s advice isn’t that hard these days, everything is just either 1 message/email/phone call away and most of your questions are answered in the shortest amount of time!

But before you start contacting Sim & Rahman for verified lawyer’s advice and solutions, here are some tips that you might want to consider or even bookmark it on your web browser.

What happens when we do not allocate our wealth/assets properly?

So, what really happens if we died without a will in Malaysia?

You might have to go through the cumbersome process of some of the classification being mentioned below.

Intestacy Law

The law that decide how your wealth and assets are being transferred and whether creditors are satisfied if a person passes away without having a will(legally binding documents) as a proof of ownership

Administrator

A person that’s nominated by the family members/court to administer the assets of a dead person who didn’t engage a lawyer to write a will when he/him is still alive

Sureties

It means guarantors

Executor/Wasi

A person that’s nominated by the will-maker to execute the terms stated in a will

Movable assets

These are belongings such as bank accounts, bonds, shares, fixed deposits, electronic devices, jewellery, car, artworks, etc.

Immovable assets

These are assets such as real estates(property) such as a bungalow, apartment, condominium and lands that are known as non-movable assets.

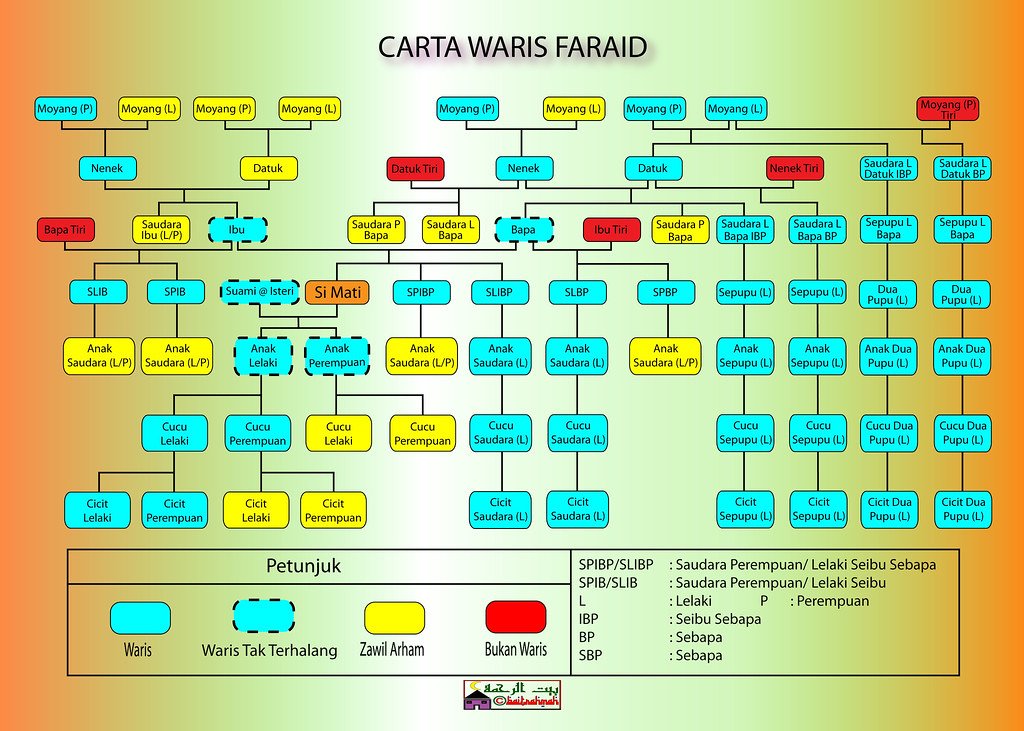

Faraid Beneficiaries

Inheritors who are entitled to get an allocated share from the heritable properties under Islamic law.

Beneficiaries

The successors that will be receiving the inheritance.

Issues

Which usually mean children and descendants in legal terms.

There’s even more interesting trivia that you haven’t discovered yet

Death will be classified as intestate if you die living no functional will and most of your estate(s), a legal term for the money in your bank accounts, properties and any other assets that you own during the time of your death will be distributed in accordance to the Distribution Act 1958.

In other words, the money and assets that you’re owning are frozen and non of your loved ones can gain access to it until and unless you have obtained the Letter of Administration from the court.

We haven’t even mentioned your EPF account or any insurance policies you have bought during your lifetime if you have failed to make any nominations on the same.

The Inheritance and Distribution Act will decide how your estates are being allocated

For your information, Muslims and non-Muslims are controlled under a different set of inheritance and distribution Act.

Read on to understand how it’s being classified

Here are some facts that you have to take into account if you’re a Muslim

#1 The estates will continue to intestate until the case is being settled.

#2 The family members have to apply for the Faraid certificate (Muslim inheritance law) from the Shariah court, which usually contains the data for the value of the estate.

The names of the entitled beneficiaries and the expected wealth distribution have to be stated upfront. The entire process will normally take about 5 days to complete.

#3 The Quranic successors(Asbahul Furud) need to have a mutual agreement for choosing a similar administrator. It needs to be either in written form and validated by the magistrate for oaths.

#4 The wealth will be allocated using the Shariah law. The entire process of wealth issuance is the same as owning a wasiat(will in Malay). The priority will be given to the provisions of funeral expenses followed by the payment of outstanding debts including zakat, incomplete haji and Nazar (solemn pledge)

All the issues mentioned above need to be solved before the remainder of the estate(s) can be distributed amongst your beneficiaries according to the Faraid law.

#5 If the beneficiaries are 18 years old and below, their share will be deposited into their Trust Account at AmanahRaya and they are only allowed to claim it once they’re officially 18 or has reached the age that’s being agreed in the Deed of Trust.

#6 What happens if he/she is a lone ranger (a person without a living family member) and nobody is claiming your estate(s)?

All the estate(s) will be handed to the Baitumal(Muslim financial institute)

#7 Before the wealth can be allocated, the beneficiaries would have to apply to the high court for letters of administration (L.A.). It depends on the estate’s value. They can also apply for the L.A. at the District Land Administrator office or AmanahRaya Berhad.

In addition to that, the administrator will need to find 2 guarantors who can guarantee the same value of assets just as yours.

It will generally take about 6-9 months!

#8 These guarantors are obliged to ensure that the estate(s) will be properly allocated and the accounts are properly processed.

This ensures that during the occurrence of illegal inheritance of the estate(s) doesn’t happen a.k.a. Stealing. The guarantors are obliged to pay the lost amount to the rightful beneficiaries.

#9 Guarantors are not needed if the total value of the estate(s) is lower than RM600k. The wealth would be allocated based-on:

Movable assets

AmanahRaya Berhad will use section 17 of the Public Trust Corporation Act 1995 to determine who can administer the estate(s) without the needs of guarantors.

Immovable assets

District Land Administrator will use the Small Estate Distribution Act 1955 to issue a distribution order, hence, no guarantors are needed for this instance.

#10 Apart from that, no guarantors are needed if a trust corporation is nominated as the administrator/if the administrator is the sole beneficiary.

Some facts you might not want to overlook if you’re a non-Muslim

#1 The estates will be frozen until the case is solved

#2 The family members have to nominate an administrator. The decision requires permission from all the interested family members involved by signing the renunciation of administration letter to be witnessed by the commissioner for oaths.

#3 The protocol for wealth allocation is the same as when you have a valid will. The priority is given to the provision of funeral expenses.

After the preference, the provision shall be made to the outstanding debts. And finally, the balance of the estate(s) shall be inherited by the beneficiaries based on Distribution Act 1958 (amended during the year 1997), while the Intestate Succession Ordinance 1968 is used for Sabah.

#4 The court may nominate a guardian for the will-owner who are still minors (children who are under 18 years old) who may not be the will-owner’s favourable candidate.

#5 Before the will-owner can allocate the wealth, the beneficiaries have to apply for Letters of Administration. Subjecting to the asset’s value, they can also apply for the L.A. at the District Land Administrator office or AmanahRaya Berhad.

Additionally, the administrator will have to seek for 2 guarantors that can guarantee the same value of the asset as the will-owner. This generally takes about a whopping 6-9 months!

#6 These guarantors must make sure that the estate(s) are being properly allocated and the accounts are properly processed.

In the event of any stealing, the guarantors have to carry the obligations of refunding the loss.

#7 Guarantors are not needed if the total value of the asset(s) is less than RM600k where the matter could only be filed in the public administrator which may takes up to 3 years to be completed.

The wealth shall be distributed by;

Movable assets

AmanahRaya Berhad under section 17 of the Public Trust Corporation Act 1995 who can administer the estate without the need for guarantors.

Immovable assets

District Land Administrator under the Small Estate (Distribution) Act 1955. A distribution order that will be issued and no guarantors are needed.

Pro-Tip: The procedure can cost the asset owner a staggering 2-5 years or more!

Say if you inherit part of a house and another owner is still living there, you and the joint-owner would have to have a mutual understanding whether him/her is allowed to continue to live there under agreed terms.

And decide if the house will be sold or remain as it is.

What happens when you have inherited a property with an existing tenant?

You have certain obligations as an owner and to take a certain responsibility as an owner which is to maintain the condition of the property!

If you ever make up your mind to sell the property, you may need to consider the legal rights that the tenant has and provide him/her with a few months’ notice to relocate.

Property inheritance is clearly defined by the Distribution Act 1958 and the Inheritance (Family Provision) Act 1971

Both of these acts clearly outline the entire terms and conditions of a legally binding document set by a law firm in Malaysia.

Whereas civil law, estate inheritance is governed by several statutes and regulations.

Civil law allows for the personal intents to dictate the ownership of an estate

During the events of the property owner through the use of a will created by a lawyer that’s situated in a law firm in Malaysia.

In other words, the only surviving parent with 3 kids could leave the whole estate to 1 out of his/her child.

As mentioned by PropertyGuru.

What does inheritance tax truly mean?

In layman’s terms, an inheritance tax was executed in Malaysia under the Estate Duty Enactment 1941.

An estate(s) of a dead person is liable to a 5% tax if it is valued above RM2 million and 10% if it is above RM 4 million.

However, this enactment was reversed during the year 1991.

What about estate(s) planning?

This is a rather complex issue, no doubt real estates are a valuable asset. But, the financial value of it is trapped in bricks and mortar.

Which is why often it’s so challenging to properly separate the value of the estate(s) equally.

According to PropertyGuru, estate(s) planning exists to remove uncertainties when it comes to allocating the estate after death by fulfilling your initial request.

If you’re 1 of those people who are lucky enough to own your real estate, you seriously need to consider estate(s) planning which happens to be at your service by Sim & Rahman.

And the last thing you would want to know is that you’ve added heartaches to your loved ones due to non-existence of a will!

So if you want to find a law firm in Malaysia and seek a solicitor’s advice plus you’re not hoping to create more troubles for your loved ones.

Go ahead and contact Sim & Rahman and let’s walk you through with our solutions!

Credits to Wasfiha from Flickr and MStar for the media.

need legal advice in malaysia?

Sim & Rahman is a lawyer firm based in Selangor, Malaysia specializing in resolving commercial/corporate disputes, will writing & probate, letter of administration and property transaction. Contact us today to get legal advice from us.

need legal advice in malaysia?

Sim & Rahman is a lawyer firm based in Selangor, Malaysia specializing in resolving commercial/corporate disputes, will writing & probate, letter of administration and property transaction. Contact us today to get legal advice from us.